THE OUR BLOG

Shares Outstanding Formula Calculator Examples with Excel Template

Posted by mhengineering in Bookkeeping

This by no means implies that increasing the number of these shares leads to guaranteed success. First, the company has to do its job and have strong, consistent financial performance, delivering constant earnings growth. Generally speaking, stocks with smaller floats will experience more volatility than those with larger floats. These statements are available on companies’ investor relations pages or the SEC website. The information is also available on stock data websites like Stock Analysis. Evaluating the trend of this number provides useful insights to investors.

- Calculating the number of outstanding shares a company has can help you to understand what proportion of a company’s stock is held by its shareholders.

- If the firm is motivated by a potential increase in its valuation metrics, it may manipulate investors.

- The whole point of companies going public is to raise money and for investors to achieve financial gains.

- Outstanding shares are calculated by subtracting treasury shares from issued shares.

- When a company files articles of incorporation, it must describe its share structure in the filing.

More specifically, treasury shares are the portion of shares that a company keeps in its treasury. It’s important to note that outstanding shares do not include treasury stock, which are shares that were once owned by investors that a corporation has repurchased. They also do not include preferred shares, which are stocks that do not carry shareholder voting rights, but do give their owners some ownership rights and pay a fixed dividend.

What is the Weighted Average of Outstanding Shares?

Multiply the price of a single stock by the number of shares outstanding to find a business’s market capitalization. All the boxes of shoes that they have, both on the floor available for sale and in the back stockroom are like authorized stock. The boxes of shoes that are out front and available for sale are like the issued stock.

Sum up the numbers of preferred and common shares outstanding and subtract the number of treasury shares. Look into the line item for preferred stock, this line makes reference to a special class of shares that gives investors certain privileges such as a periodic dividend. There should be a description that states the number of shares outstanding.

Float shares of the company are the ones that are available for trading to the public. In other words, it doesn’t include shares that are closely held or restricted stock. Insider shares that are limited from trading for a short time, such as the IPO lock-in period, are referred to as restricted stock. Shares that are closely held are those that are owned by key shareholders, insiders, and employees. The number of shares outstanding can be computed as either basic or fully diluted.

Outstanding Shares: Everything You Need to Know

The total number of shares outstanding is the number of shares that external investors, as well as insiders such as executives or employees, own. The number of shares outstanding consists of shares held by institutions, restricted shares held by company insiders, and shares available for investors to buy and sell on the open market. The number of outstanding shares is calculated by subtracting treasury stock from the shares issued. Generally, you won’t need to calculate this number yourself and it will be listed for you on a company’s 10-Q or 10-K filing. For example, you can calculate a company’s earnings per share (EPS), a common metric used to compare companies’ performances.

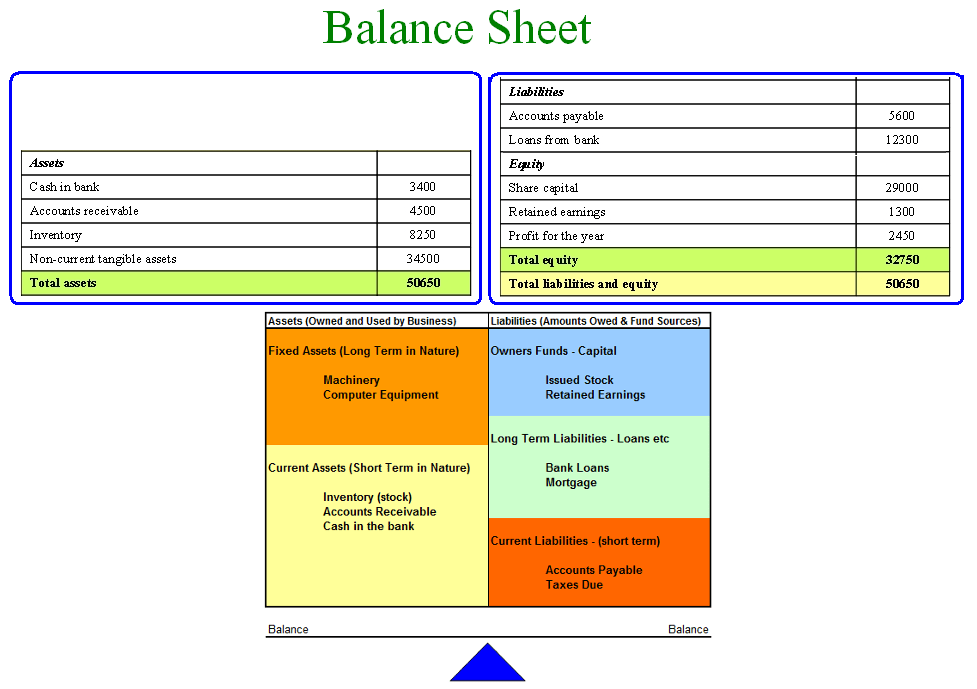

In some nations such as the United States, these figures are accessible from the Securities and Exchange Commission (SEC) quarterly filings. Outstanding shares are the company’s stock that shareholders are currently holding which includes shares that institutional investors hold as well as restricted shares that company officers and insiders own. In other words, they are shares that are available with the company’s shareholders after excluding the shares that the company bought back, that is treasury stock. It is shown as part of the owner’s equity on the liability side of the balance sheet, under the heading, “Capital Stock”. We can say that Any authorized shares that are held by the corporation’s shareholders or are sold to them, excluding treasury stock which the company holds itself, are shares outstanding.

The larger stock market is made up of multiple sectors you may want to invest in. Let’s take an example to understand the calculation of Shares Outstanding in a better manner. Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts.

Importance of shares outstanding

Investors should also be wary when companies announce plans to buy back shares. If the firm is motivated by a potential increase in its valuation metrics, it may manipulate investors. Stock splits are generally undertaken to make the share price of the firm fall within the range of what retail investors are willing to pay. Treasury shares are the shares which are bought back by the issuing company, reducing the number of shares outstanding on the open market.

Conversely, they decrease if the company buys back some of its issued shares through a share repurchase program. Another factor that causes the outstanding stocks of a company to fluctuate is the stock split. On the other hand, it will reduce if the company undertakes a reverse stock split. Usually, companies undertake stock splits in order to bring a company’s share price within the buying range of retail investors.

Shares outstanding are the basis of several key financial metrics and can be useful for tracking a company’s operating performance. However, due to the fluctuations in share counts between reporting periods, the figure is typically expressed as a weighted average. The number of shares outstanding of a company can be found in its quarterly or annual filings (10-Qs or 10-Ks). These individuals have no real intention of selling the stock; if they do, they must inform the public of their decision. These shares are effectively locked up and not going to be available to the public (at least in the short term). As a result, the company may initiate a repurchase program to buy back some of its stock.

What Is the Difference Between Shares Outstanding and Floating Stock?

Before making decisions with legal, tax, or accounting effects, you should consult appropriate professionals. Information is from sources deemed reliable on the date of publication, but Robinhood does not guarantee its accuracy. Companies can later sell the shares they repurchase, allowing them to raise additional funds if the value of the shares increases.

Calculating The Fair Value Of Agiliti, Inc. (NYSE:AGTI) – Simply Wall St

Calculating The Fair Value Of Agiliti, Inc. (NYSE:AGTI).

Posted: Sun, 20 Aug 2023 14:11:22 GMT [source]

Weighted average shares outstanding is the process of weighting every number of common stock to reflect how much time they were in effect. Suppose that Sample Company had 100,000 shares of common stock outstanding on 1 January 20×1, that 20,000 shares were issued for cash on April 1, 20×1, and that 12,000 shares were retired on 1 September 20×1. At the end of it all, the number of outstanding shares decreased by 1000 shares while earnings per share increased by 6.89%. Recognizing that a company’s number of shares outstanding can change is also useful. For example, the difference between the number of shares currently outstanding and the number of shares fully diluted is comparatively likely to be significant for fast-growing technology companies.

The fully diluted number of shares indicates how many outstanding shares there could potentially be if all existing equity instruments were converted into common stock. Corporations raise money through an initial public offering (IPO) by exchanging equity stakes in the company for financing. An increase in the number of shares outstanding boosts liquidity but increases dilution. Typically, a stock split occurs when a company is aiming to reduce the price of its shares.

They are separate from treasury shares, which are held by the company itself. In addition to listing outstanding shares or capital stock on the company’s balance sheet, publicly traded companies are obligated to report the number of issued along with their outstanding shares. These figures are generally packaged within the investor relations sections of their websites, or on local stock exchange websites. Share equivalents include stock options, warrants, future stock purchase rights, or convertible instruments that can be converted into stock. Also, it is important to calculate shares outstanding as a common stock equivalent. A class of preferred shares may convert into a larger number of common shares.

Outstanding Shares

A share repurchase generates a higher income per share, making each share more valuable. Conversely, the outstanding number of shares will decrease if the company buys back some of its issued shares through a share repurchase program. The outstanding shares figure is useful to know for an investor that is contemplating buying shares in a company. Dividing the number of shares to be purchased by the number of shares outstanding reveals the percentage of ownership that the investor will have in the business after the shares have been purchased.

- The company would be buying back outstanding shares to put in its treasury.

- Outstanding shares of stock is the kind of stock issued by the company that is owned by investors, rather than by corporations themselves.

- The actual amount of stock that is willing to sell is generally less than the amount authorized and is called issued stock.

- Therefore, the total number of shares outstanding of Apple Inc. at the end of the year 2016 is 5,336.16 million.

- “Issued shares” are a company’s authorized shares that are sold to shareholders, including those sold and held by company founders and insiders, institutional investors, and the general public.

It is pretty common for a company to restate the articles of incorporation to authorize additional shares when necessary for an equity financing round. The company may increase the number of authorized shares of common stock or create new classes of preferred stock. It is an important consideration, however, as some jurisdiction charge franchise How to calculate shares outstanding taxes based upon the number of shares authorized. Also, if a company has a certain capitalization, it may need issue a certain number of shares to create the desired value per share being issued. While outstanding shares are those held by shareholders and insiders, the float is the number of shares that are available for trading.

The weighted average method doesn’t consider shares that can be potentially created through various mechanisms. As a result, the weighted average of outstanding shares will not tell you the diluted earnings per share. The weighted average can calculate significant financial metrics more accurately, like earnings per share for a specific period. Earnings per share is an important metric used to measure how much net profit the firm earns for each share of its stock.

Issued and outstanding shares are the total number of shares that are already in the hands of founders, investors, and employees/advisors/contractors. To understand the calculation of outstanding shares, let us take an example of a company that has recently issued 1000 shares. Out of these, 600 shares are issued as floating shares for the public, and 200 shares are issued as restricted shares to the company insiders. Alternatively, the total number of shares outstanding can be easily calculated as a company’s market capitalization divided by the current share price. Let us consider an example of a company named KLX Inc. in order to illustrate the computation of shares outstanding. During 2018, the company repurchased 0.3 million common stocks and 0.1 million preferred stocks.

This usually means that they are performing well and have been having success. While there seems to be an abundance of positive effects through a share repurchase program, there are still some things that businesses should keep in mind before implementing one. Outstanding shares are the number of a company’s shares available on the secondary market. In two months, the company’s management decides a share buyback of 1,000 shares.