THE OUR BLOG

Accounts Receivable Aging Report: Templates and Creation Guide

Posted by mhengineering in Forex Trading

Like Quickbooks and Freshbooks, Xero is also an all-in-one accounting software. However, be careful because Freshbooks isn’t a full accounting software like Quickbooks, so you’ll need to make sure beforehand that it does everything you need it to do. We can take our analysis one step further by calculating the Doubtful Debt Allowance to book at the review date. By employing the average historical percentage of uncollected balances for each bracket, we arrive at DDA of €1,120 thousand. Remember, this is not the expense we have to book for the period, but the balance of the provision. What we usually do in practice is to book only the change from the previous period’s DDA balance.

In this step, we’ll determine the total number of days that have passed since the due date. I strongly believe that from now you may be able to do aging analysis in Excel. If you have any queries or recommendations, please share them in the comments section below. If you are looking for some special tricks to do aging analysis in Excel, you’ve come to the right place.

How to Create Debtors Ageing Report in Excel Format

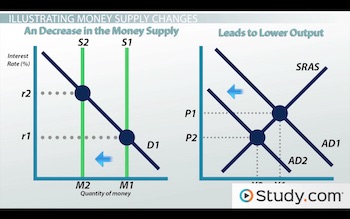

Aging reports are a valuable tool for assessing and estimating bad debts and the corresponding doubtful debt allowance (DDA). Generally, the longer an invoice remains open, the slimmer the chance to collect gets. The sales department should pay attention to the report as well, as it can help determine selling practices and credit terms.

This will populate the formula down the whole column so you do not have to enter it in over again. In some situations, you may need not only calculate age in Excel, but also highlight cells which contain ages that are under or over a particular age. The formula is inserted in the selected cell momentarily, and you double-click the fill handle to copy it down the column.

Credit Risk Management Software

In some situations, however, you may need something very specific. Our company has a 30-day payment term with all clients, so it’s easy to calculate the maturity date for all invoices. One way to evaluate the company’s performance in terms of collectability and minimizing long overdue receivables is to calculate the Average Collection Period. We then assess its trend, looking at how it develops over time.

2 is the column index number and TRUE is for an approximate match. Now try to make the creditors aging analysis in which you have determine which invoice is falling due in next specific time lapses. Here we have a list of all open invoices from our accounting software. As a minimum, we need three columns to work with — client, invoice amount, and maturity date. The reason we work with the maturity date, instead of the invoice date, is that the invoice does not become overdue until the maturity date has passed.

3D Ultrasound Market to Cross USD 6.17 Billion in 2030 on Account of Rising Prevalence of Chronic Diseases and Surge in Minimally Invasive Procedures Research by SNS Insider – Yahoo Finance

3D Ultrasound Market to Cross USD 6.17 Billion in 2030 on Account of Rising Prevalence of Chronic Diseases and Surge in Minimally Invasive Procedures Research by SNS Insider.

Posted: Fri, 04 Aug 2023 13:00:00 GMT [source]

You will learn a handful of formulas to calculate age as a number of complete years, get exact age in years, months and days at today’s date or a particular date. It is the primary tool to determine overdue balances for collection. It’s useful for the company’s management, as it helps to evaluate the effectiveness of the credit control function. In this article, we’ll show you the easy step-by-step guidelines to create a debtors ageing report in an excel worksheet.

Watch a walkthrough OR continue reading for something additional!

An aging report is a report that categorizes the balances of a company’s clients based on the length of time their invoices are outstanding – its age. These accounts are usually categorized into 30-day intervals. Thus, allowing the company to assess its clients in greater detail than if they only evaluated them based on their outstanding balances. This is important because it allows a company to take a step back and evaluate which of their clients are risky to do business with. In these cases, the company might contact their client to notify them of their outstanding invoices and further negotiate business terms if the client fails to pay for their invoices. Thus, the aging report is a tool that helps firms weed out bad clients and improve accounts receivable turnover.

Most accounting software also allows you the ability to create a detailed A/R report as well, which shows each individual item or invoice due based on vendor. This helps when accounting needs to identify individual invoices for collection. Based on the days_overdue data, we will assign an ageing_group. The way this works is by providing brackets of values and looking at where the current invoice fits within those ranges, based on its days_overdue. Remember how we split into groups, usually an increment of one month. The Days Sales Outstanding ratio shows us the average period between the date a sale originates and when the customer settles the amount.

One option is to take an average number of days for all outstanding balances. Another is to separate them into groups if the terms vary a lot for different customers. A common approach is to look at historical data and see what portion of each bucket ended up uncollectible in prior periods. We then take the average percentage and apply it to our current aging report’s balance in each bracket. The sum of these totals gives us the Expected Credit Loss for the business. And it is also this value that the accounting department books as Doubtful Debt Allowance.

Seasonality and Trend Forecast with Regression in Excel

If the collection of outstanding balances from customers slows down, this can warn that business is also slowing down. This aging report template will help you categorize accounts receivables by how long invoices have been outstanding, as well as calculate your allowance for doubtful accounts. If you’d prefer to create your accounts receivable aging analysis in excel aging report manually with a software like Microsoft Excel or Google Sheets, you can do that as well. Another thing we can do is not only look at individual customers but take a look at the totals for each aging group to get a feel of the collectability within the company. We have around 6% of our balances delayed by more than 90 days.

We put our clients’ data in the rows and split the balance of each client per the aging groups in the columns. It is crucial to remember that the Aging report can sometimes be misleading. If a client has a sizeable outstanding due on Monday, but their payment day is Friday, they will end up in our report as delayed.

Step 2: Use Formulas for Aging Analysis

Highlight all the rows in the E column then click Conditional Formatting on the Home tab and New Rule. But what if your formula displays age in years and months, or in years, months and days? In this case, you will have to create a rule based on a DATEDIF formula that calculates age from date of birth in years.

This tutorial will explain the advantages and drawbacks of each way, shows how to make a perfect age calculation formula in Excel and tweak it for solving some specific tasks. Nowadays, it’s generally much easier to use a software like Quickbooks to generate account reports such as an A/R aging report. Most retail businesses do not carry receivables because they tend to sell product for cash on delivery. To put it simply, the report tells you how much your money your company is owed, therefore the report that has several important uses in business loan underwriting. What you have due to you can also be added to your balance sheet to show larger equity.

Of course, they are much simpler because they include just one DATEDIF function to return age as the number of complete months or days, respectively. The calculator uses the following formulas to compute age based on the date of birth in cell A3 and today’s date. The generic age calculation formulas discussed above work great in most cases.

CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation. CFI is on a mission to enable anyone to be a great financial analyst and have a great career path. In order to help you advance your career, CFI has compiled many resources to assist you along the path. For more resources, check out our business templates library to download numerous free Excel modeling, PowerPoint presentation, and Word document templates. To create a dynamic summary of the aging analysis, we are going to create a chart.

My current goal is to write technical contents for anybody and everybody that will make the learning process of new software and features a happy journey. Moreover, we can add remarks to make the report more practical. The concerned persons take decisions according to these remarks.

- This is important because it allows a company to take a step back and evaluate which of their clients are risky to do business with.

- It is also a good idea to do a quick flux analysis comparing how the brackets’ amounts changed from the previous Aging Report, and investigate large variances.

- In simpler words, an A/R aging report shows the age of your open invoices or for how long your invoices have remained past-due.

- If a client has a sizeable outstanding due on Monday, but their payment day is Friday, they will end up in our report as delayed.

- If you have any queries or recommendations, please share them in the comments section below.

What you see above is an embedded Excel Online sheet, so feel free to enter your birthdate in the corresponding cell, and you will get your age in a moment. If you’d like to have your own age calculator in Excel, you can make one by using a few different DATEDIF formulas explained below. If you’d rather not reinvent the wheel, you can use the age calculator created by our Excel professionals. Let’s say you are working with a medical database, and your goal is to find out the patients’ age at the time they underwent the last full medical examination.