THE OUR BLOG

Cost of Goods Sold COGS Explained With Methods to Calculate It

Posted by mhengineering in Bookkeeping

If you receive dividends from business insurance and you deducted the premiums in prior years, at least part of the dividends are generally income. For more information, see Recovery of amount deducted (tax benefit rule) in chapter 1 under How Much Can I Deduct. Indirect costs include premiums for insurance on your plant or facility, machinery, equipment, materials, property produced, or property acquired for resale. You can’t take the deduction for any month you were eligible to participate in any employer (including your spouse’s) subsidized health plan at any time during that month, even if you didn’t actually participate.

Knowles Reports Q2 2023 Financial Results and Provides Outlook … – Silicon UK

Knowles Reports Q2 2023 Financial Results and Provides Outlook ….

Posted: Wed, 02 Aug 2023 19:02:00 GMT [source]

The facts are the same as in the previous example, except that you sold only half of the timber products in the cutting year. You would deduct $20,000 of the $40,000 depletion that year. You would add the remaining $20,000 depletion to your closing inventory of timber products. A lessor’s gross income free r&d tax credit calculator from the property that qualifies for percentage depletion is usually the total of the royalties received from the lease. The partnership or S corporation must allocate to each partner or shareholder its share of the adjusted basis of each oil or gas property held by the partnership or S corporation.

What is the Difference Between Cost of Goods Sold vs. Operating Expenses?

The IRS Video portal (IRSVideos.gov) contains video and audio presentations for individuals, small businesses, and tax professionals. The following IRS YouTube channels provide short, informative videos on various tax-related topics in English, Spanish, and ASL. Also, the IRS offers Free Fillable Forms, which can be completed online and then filed electronically regardless of income.

- Because a COGS calculation has so many moving parts, it can be prone to errors and subject to manipulation.

- For gift loans between individuals, forgone interest treated as transferred back to the lender is limited to the borrower’s net investment income for the year.

- Instead, they would include the cost of those items as tax deductions for operational costs.

- The average cost method includes calculating the average price of the goods bought, and then they are recorded at that cost when being sold.

Engaging in the payment of bribes or kickbacks is a serious criminal matter. You can claim a deduction for travel and non-entertainment-related meals expenses if you reimburse your employees for these expenses under an accountable plan. Generally, the amount you can deduct for non-entertainment-related meals is subject to a 50% limit, discussed later.

Learn How We Can Impact Your Business Growth

Fees you incur to have business funds available on a standby basis, but not for the actual use of the funds, are not deductible as interest payments. If you use the cash method of accounting, you cannot deduct interest you pay with funds borrowed from the original lender through a second loan, an advance, or any other arrangement similar to a loan. You can deduct the interest expense once you start making payments on the new loan. If you paid $600 or more of mortgage interest (including certain points) during the year on any one mortgage, you will generally receive a Form 1098 or a similar statement.

For information about amortizing startup and organizational costs, see chapter 8. Generally, if the special rules apply, you must use an accrual method of accounting (and time value of money principles) for your rental expenses, regardless of your overall method of accounting. You can deduct actual car expenses, which include depreciation (or lease payments), gas and oil, tires, repairs, tune-ups, insurance, and registration fees. Or, instead of figuring the business part of these actual expenses, you may be able to use the standard mileage rate to figure your deduction.

- For example, the depreciation period for computer software that isn’t a section 197 intangible is generally 36 months.

- If you make this election, you must maintain adequate records to support your deduction.

- However, for the DIY CEO, calculating cost of goods sold requires a bit of information prep beforehand in order to report accurately.

- Also, you can deduct any additional taxes in the prior year if you do not show some affirmative evidence of denial of the liability.

He is the sole author of all the materials on AccountingCoach.com. To see our product designed specifically for your country, please visit the United States site. This free cost of goods sold calculator will help you do this calculation easily.

Cost Of Goods Sold For Manufacturing Business

You can generally deduct the ordinary and necessary cost of insurance as a business expense if it is for your trade, business, or profession. However, you may have to capitalize certain insurance costs under the uniform capitalization rules. Your deduction for wages paid is not reduced by the social security and Medicare taxes, Additional Medicare Tax, and income taxes you withhold from your employees.

You recover your interest when you sell or use the property. If the property is inventory, recover capitalized interest through cost of goods sold. If the property is used in your trade or business, recover capitalized interest through an adjustment to basis, depreciation, amortization, or other method. Under the uniform capitalization rules, you must generally capitalize interest on debt equal to your expenditures to produce real property or certain tangible personal property. The property must be produced by you for use in your trade or business or for sale to customers. You cannot capitalize interest related to property that you acquire in any other manner.

What is the Relationship Between COGS vs. Gross Profit?

On most income statements, cost of goods sold appears beneath sales revenue and before gross profits. You can determine net income by subtracting expenses (including COGS) from revenues. Cost of goods sold (COGS) is calculated by adding up the various direct costs required to generate a company’s revenues.

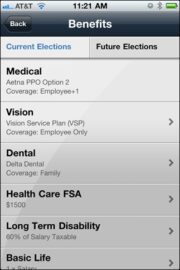

See chapter 8 for more information on qualifying reforestation costs and qualified timber property. You must also recapture deducted exploration costs if you receive a bonus or royalty from mine property before it reaches the producing stage. Do not claim any depletion deduction for the tax year you receive the bonus or royalty and any later tax years until the depletion you would have deducted equals the exploration costs you deducted. If you have more than one health plan during the year and each plan is established under a different business, you must use separate worksheets (Worksheet 6-A) to figure each plan’s net earnings limit. Include the premium you paid under each plan on line 1 or line 2 of that separate worksheet and your net profit (or wages) from that business on line 4 (or line 11). For a plan that provides long-term care insurance, the total of the amounts entered for each person on line 2 of all worksheets can’t be more than the appropriate limit shown on line 2 for that person.

Any excess loss or credits are carried over to later years. Suspended passive losses are fully deductible in the year you completely dispose of the activity. This chapter covers the general rules for deducting business expenses. Business expenses are the costs of carrying on a trade or business, and they are usually deductible if the business is operated to make a profit.

There are two ways to calculate COGS, according to Accounting Coach. Cost of goods sold (COGS) is the direct cost of producing products sold by your business. Also referred to as “cost of sales,” or “COGS report,” COGS includes the cost of materials and labor directly related to the production and manufacturing of retail products.

Average Cost

If the partner cannot deduct the entire share of partnership costs, the partnership can add any costs not deducted to the basis of the improved property. A facility is all or any part of buildings, structures, equipment, roads, walks, parking lots, or similar real or personal property. You elect to capitalize circulation costs by attaching a statement to your return for the first tax year the election applies. Your election is binding for the year it is made and for all later years, unless you get IRS approval to revoke it.

If part of the tax is for maintenance, repairs, or interest, you must be able to show how much of the tax is for these expenses to claim a deduction for that part of the tax. If you use an accrual method, you generally cannot accrue real estate taxes until you pay them to the government authority. However, you can elect to ratably accrue the taxes during the year. A taxing jurisdiction can require the use of a date for accruing taxes that is earlier than the date it originally required.

Woodward Reports Third Quarter Fiscal Year 2023 Results – GlobeNewswire

Woodward Reports Third Quarter Fiscal Year 2023 Results.

Posted: Mon, 31 Jul 2023 20:05:22 GMT [source]

It assumes that the ending inventory on hand are the oldest units produced, and that the newest units produced have already been sold. During periods when costs for raw materials or labor are increasing, LIFO yields a lower per-unit valuation of inventory for those items still on hand, because they were produced earlier in the period. If you fail to file voluntarily, we may file a substitute return for you, based on income reported to the IRS. This return might not give you credit for deductions and exemptions you may be entitled to receive.