THE OUR BLOG

Comprehensive Accountancy Services & Offshore Accounting Solutions

Posted by mhengineering in Bookkeeping

Companies often prefer to offshore their accounting tasks to an external accounting firm. There will always be a need for a highly specialized team, making it impossible to how to account for capital improvements offshore all accounting activities. Since you won’t be able to outsource the finance activities altogether, you must ensure the onshore and offshore teams can interact efficiently. Verify their preparedness for data loss, recovery, and transmission security. Using compliance certificates research into industry standards, you can ensure that the provider’s security policies are up to line. “According to the Clutch report, Accounting and IT services are small businesses’ most popular outsourced processes”.

If you do not have enough employees to handle specific tasks, the tendency is your in-house team will fill in more roles and tasks. As an entrepreneur, you need insights into all your financial information in making business decisions. Maintaining all your financial records accurate and up-to-date is also critical in keeping your company up and running. Your accounting plays a big and very important role in your business management. A recent Deloitte survey clues us in on how you can attract millennials to your accounting firm.

What is an offshore accounting service?

Consistent quality and happy customers are only possible if they follow all accounting laws. Many businesses worry about their data getting exposed when hiring offshore services. One good thing about hiring offshore services is that they get to hire a team for a short period, either within their peak season or on red dates. Businesses often opt to utilize offshore accounting, primarily due to the advantages offered by offshore bookkeeping services. While most businesses take care of these in-house jobs, some prefer to hire an offshore team from other countries such as India and the Philippines.

Most accounting firms in offshore countries follow deadlines and compliances in the West, where most of their clients are located. Technological advancements, regulatory reforms, and geopolitical shifts are shaping the future of offshore accounting. Innovations in financial technology (fintech) facilitate faster, more secure cross-border transactions and enhance transparency in offshore financial management.

By outsourcing accounting to an offshore company, you can boost your business and stay on top of your industry. Your accountant’s workload could increase, especially during certain days or a time of the year – which may burden them and increase the chances of errors. By outsourcing accounting, you reverse treasury stock method can get error-free data without overburdening your employees. Moreover, the accountant in your outsourced firm may know more about the accounting trends as they deal with different types of clients. However, when you offshore accounting to a CPA (Certified Public Accountant) or any other CPA firm, you must ensure that they fit your unique business requirements.

Things to consider before you offshore accounting

- This can cost your business more than expected, especially with the quality of their work and your products slowly decreasing.

- Maintaining all your financial records accurate and up-to-date is also critical in keeping your company up and running.

- Tax preparation services can also help you with international tax compliance so you can avoid charges related to tax evasion.

- As part of their operations, they follow standard procedures according to international standards and data privacy laws in their markets.

Consider the preferences and well-being of your offshore team, recognizing that their working hours may not align with your own. While this tip may not be related to any specific accounting process, it could go a long way in terms of team morale, retention, and overall collaboration. The key to the whole offshoring approach is hiring the best talent with the right attitude.

Taxation Services

Initially, you can offshore only those tasks that may be difficult or costly to operate in-house. Once you’ve figured out a comfortable pace and style of working with the offshore vendor, you can outsource the remaining services too. This cost-effective strategy can help ambitious small businesses to scale up and down with ease. section 338 business sale Offshore accounting services can help your business gain a competitive advantage. It is increasingly difficult in industrialized countries such as the US and UK to find qualified accounting talent.

Is remote accounting the same as outsourced accounting or BPO?

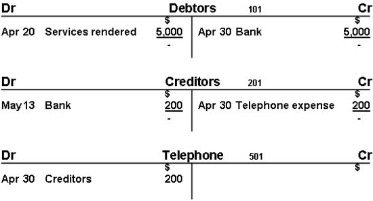

These countries also provide accounting experts who have graduated from top financial institutions. You can be sure you fully comply with all applicable state, federal, and local regulations when you outsource your tax preparation and filing. Financial documents, purchases, accounting entries, and payroll will be compared and contrasted as part of this process. Offshore accounting services rely on talents that are experienced in handling volumes of documents, bills, and books of accounts of your company. Employers get to hire global talent that is suitable for the role they need at a quarter of a local talent’s cost. Offshore accounting offers high-quality services at a fraction of the cost of hiring in-house staff, and the outsourced team can feel almost the same as an in-house staff.