THE OUR BLOG

9 Assets for Protection Against Inflation and the ETFs that Track Them

Posted by mhengineering in Forex Trading

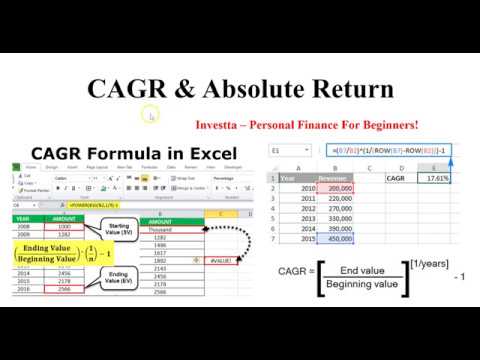

Futures markets are regulated by the Commodity Futures Trading Commission (CFTC). Futures also come with their own set of unique risks that must be managed independently of the underlying commodity. In the opening paragraph, we quoted the BLS inflation figure of 8.6% over the most recent year. That’s certainly high by historic standards, but it gets even worse when you look over the long term. Another option is I Bonds, which is currently paying an incredible 9.62%.

Standard Digital includes access to a wealth of global news, analysis and expert opinion. Premium Digital includes access to our premier business column, Lex, as well as 15 curated newsletters covering key business themes with original, in-depth reporting. This website is using a security service to protect itself from online attacks. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. Investing Simple readers can claim a free stock from Robinhood worth up to $200 when they open a brokerage account and deposit any amount. Gemini offers trading in over 40 cryptocurrencies, and also offers its own stablecoin—the Gemini dollar.

Best Investment Hedges Against Inflation

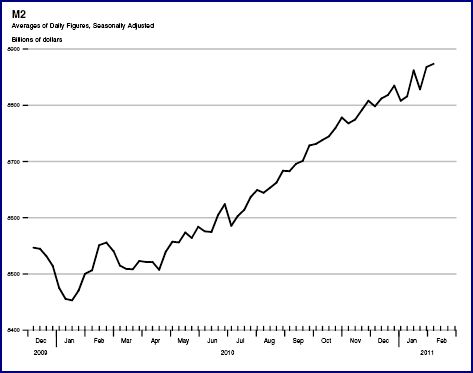

Instead, you’ll need to purchase it through cryptocurrency exchanges. As an alternative currency, crypto may increase in popularity as traditional currencies continue to devalue. This may at least partially explain the price explosion of Bitcoin and other cryptos since early 2020.

- In the meantime, you’ll lock in a strong return while maintaining optionality for your investable cash.

- However, you are limited to purchasing no more than $10,000 in I Bonds per calendar year.

- Diversifying your portfolio and investing in assets that have traditionally outpaced the rate of inflation is the best way to prepare your portfolio for inflation.

- Other key categories include supply of gold, investor sentiment and other commodity market dynamics.

Commodities and inflation have a unique relationship, where commodities are an indicator of inflation to come. As the price of a commodity rises, so does the price of the products that the commodity is used to produce. There is no specific time that constitutes the best time to buy commodities. Commodities are a hedge against inflation, so buying before periods of high inflation is a good investment strategy; however, predicting when inflation will occur can be tough.

VTIP’s safe, inflation-protected holdings perform particularly well during periods in which recessions, market volatility, and inflation are all common. These have been quite common since 2020, during which the fund has outperformed bonds in general and all bond sub-asset classes. Lots of investors are concerned about inflation and with good reason. Commodity prices are surging, and U.S. inflation measures are at their highest levels in decades.

Best Investments To Beat Inflation

Fundamentally, one of the reasons why crypto could prove to be the best inflation hedge of all is because it represents an alternative currency. Inflation is, after all, excess production of sovereign currencies, lowering their value against real assets. Even as a small investor, with no knowledge of the fine art market, you can participate in this asset class.

There are some disadvantages to investing in the Bloomberg U.S. Aggregate Bond Index as a core fixed-income allocation. Jeff Rose, CFP® is a Certified Financial Planner™, founder of Good Financial Cents, and author of the personal finance book Soldier of Finance. Jeff holds a Bachelors in Science in Finance and minor in Accounting from Southern Illinois University – Carbondale. In addition to his CFP® designation, he also earned the marks of AAMS® – Accredited Asset Management Specialist – and CRPC® – Chartered Retirement Planning Counselor. While a practicing financial advisor, Jeff was named to Investopedia’s distinguished list of Top 100 advisors (as high as #6) multiple times and CNBC’s Digital Advisory Council. Jeff is an Iraqi combat veteran and served 9 years in the Army National Guard.

How to Invest in Crude Oil

Finally, real estate can be a good hedge against inflation because property values over time tend to stay on a steady upward curve. Most of the homes that hit rock bottom when the real estate bubble burst in 2008 were back to their pre-crash prices in less than a decade. Real estate investments can also provide potential recurring income for investors and can keep pace or exceed inflation in terms of appreciation. On way investors can do that in periods of high inflation is to identify businesses that have enduring pricing power. If these companies can periodically raise the prices their customers pay without negative impacts to demand, then they are in a prime position to do well if inflation rises quickly. Commodities Arnott’s research illustrates that commodities have a more consistent record as inflation hedges than real estate or gold.

I bonds issued from November 2022 through April 2023 have a fixed rate of 0.40% and an inflation adjustment of 6.49%, for a total initial yield of 6.89%. The best way to hedge against inflation is to invest in assets that maintain their value—or increase in value—over a specified period of time. Over shorter periods, researchers found gold’s inflation-adjusted price fluctuates dramatically. If gold were a simple, reliable inflation hedge, its value would remain roughly constant relative to the CPI. While the inflation-hedging aspect of TIPS can make them an appealing way to preserve the purchasing power of your money, understand that they don’t provide much in the way of growth. Over the past 10 years, the iShares TIPS Bond ETF, which tracks a TIPS index, posted average annual returns of just over 3%.

REITs

However, rental properties can be an excellent way to build wealth over time and can protect against inflation. Historically, home prices as well as rental rates have kept pace with inflation — or slightly more — over long periods of time. In fact, rising home prices have been one of the main drivers of the inflation we’ve best business jobs been seeing. When inflation rises, consumers tend to pump the brakes on spending. But the biggest cutbacks happen in discretionary spending; that is, people stop buying things they want but don’t need. On the other hand, businesses that sell things that people need tend to do just fine during inflationary periods.

So in addition to inflation protection, you’ll also get some diversification, meaning your portfolio may benefit from lower risk. Bonds usually offer a fixed payment for the life of the bond, meaning bonds have their broad side exposed to rises in inflation. One way to mitigate that effect, however, is with a floating-rate bond, where the payout rises in response to upticks in interest rates caused by rising inflation. Some businesses can thrive during inflation, when prices are rising. Banks, for example, earn more money as interest rates rise and profit off the increased price of loans.

If inflation returns, it’s generally a punch in the jaw for the bond market, but it could be a shot in the arm for the stock market. Consider reallocating 10% of your portfolio from bonds to equities in order to take advantage of this possible trend. Here are the top five asset classes to consider when seeking protection from inflation. https://1investing.in/ They range from equities to debt instruments to alternative investments. All are feasible moves for the individual investor to make, though they carry different degrees of risk. Inflation is defined by the rate at which the value of a currency is falling and, consequently, the general level of prices for goods and services is rising.

After all, inflation doesn’t just affect current consumption—it also eats into investment returns and erodes wealth. Many inflation-averse investors turn to real estate to hedge their holdings, although the size and variability of the market can make it very difficult to generalize about this particular asset class. Investing in a diversified portfolio of stocks is an excellent way to fend off inflation. From July 2012 to July 2022, the S&P 500—a key benchmark for U.S. stocks—generated an average annualized return of nearly 11% (with dividends reinvested). After accounting for inflation, you’re still looking at about 8.3% average annual returns.

How Balanced Advantage Funds can give you the Best of Both Worlds – Moneycontrol

How Balanced Advantage Funds can give you the Best of Both Worlds.

Posted: Thu, 14 Sep 2023 04:54:55 GMT [source]

Using this list, you can decide which are the best fit for your particular goals and risk tolerance and help protect your portfolio from the effects of rising consumer prices. Alternatively, when the economy is stable and investors turn to traditional investments, like stocks and bonds, the price for gold tends to decline. Treasury has designed a type of bond specifically to combat inflation. Colananni recommends I bonds as the best potential inflation hedge. Look for long-term investments that earn at least 3.7%, the average U.S. inflation rate going back to 1960. You should also diversify your portfolio—especially by owning assets that have historically outpaced the rate of inflation—to help protect against potential losses.

About Our Investing Expert

It’s a staple investment of the wealthy, and it’s not hard to see why. Not only does it offer the potential for price appreciation, but also the predictability of current income from the rents collected from the properties. It’s an illiquid investment that will take several years to pay out. To participate, you’ll need to be either high income, high net worth, or both.

But it’s that volatility that might make them the very best plays in an inflationary environment. Let’s say that you bought a 30-year Treasury bond paying 2.5% interest a couple of years ago. If the yield on new 30-year Treasuries rises to 4%, your bond becomes intrinsically less valuable. You’ll still collect your interest payments (at the 2.5% rate), but the market value of the bond — should you need to sell it — will drop significantly.

Moreover, younger investors likely have the bulk of their portfolios in stocks–and while stocks aren’t a direct hedge against inflation, their returns typically outpace inflation over time. As such, stocks can help investors maintain their purchasing power in an inflationary environment. There are different ways to protect an investment portfolio from high inflation. For example, Morningstar’s Christine Benz suggests that younger investors should maintain ample stock exposure. Retirees and pre-retirees who depend on their investments for cash flows may need to seek out inflation protection in fixed-income assets. I would submit that investors will likely come out ahead using assets like REITs, short-term nominal bonds, and TIPS.

Yet that’s exactly what it is, and the reason why it’s commonly held by wealthy investors. You can invest in portfolio-type investments with as little as $500. You’ll have an option of investing in properties for long-term growth, income generation, or a combination of both. Although gold has proven its long-term value over thousands of years, there are other options. For example, since 1973, energy stocks have been the top-performing sector during periods of high and rising inflation.

RECENT POSTS

- Tips For Playing Slots at the best Casino Online

- The Benefits of Using Neteller for Online Gambling Enterprise Deals

- Cent Slot Machine free of charge: A Guide to Low-Stakes Online Gaming

- Slots Machine Online Slots Machine Online A Must Know Guide to play Slots Online

- Online Casino Sites that Approve Neteller: A Convenient and Secure Repayment Alternative